In today’s financial – centered world, banks play a crucial role in safeguarding their operations and customers’ information. One important aspect of this is verifying driver’s licenses to prevent fraud. Here are the various ways banks go about this process.

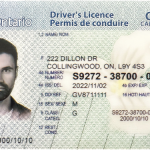

Visual Inspection

The first step in the verification process is often a visual inspection. Bank tellers and customer – service representatives are trained to look for specific features on the driver’s license. These features include the holographic images that are difficult to replicate. For example, many modern driver’s licenses have a hologram of the state seal or the license – holder’s photo embedded on the card. The color and clarity of the text on the license are also examined. Real driver’s licenses typically have sharp, well – defined text, while fake ones may have blurry or pixelated text. Additionally, the paper or plastic material of the license is inspected. Genuine licenses are made from high – quality materials that have a certain texture and thickness. A fake license may feel flimsy or have an unusual texture.

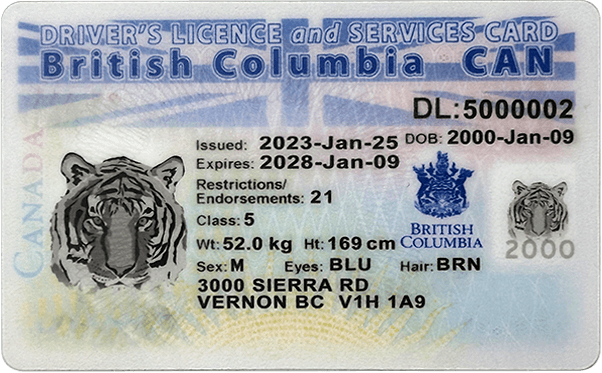

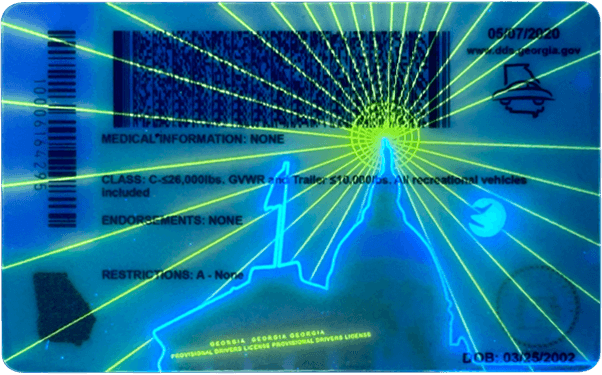

Microprinting and Security Features

Many driver’s licenses incorporate microprinting as a security feature. This is text that is so small that it is difficult to reproduce accurately. Banks use magnifying tools to check for the presence of microprinting. If the microprinting is missing, smudged, or not in the correct location, it could be a sign of a fake license. Another security feature is the use of UV – reactive inks. When a driver’s license is exposed to ultraviolet light, certain elements on the license, such as the license – holder’s photo or specific text, may glow or change color. Banks may have UV lights available to test for these features. If the expected UV – reactive elements do not respond as they should, it may indicate that the license is fake.

Data Verification

Banks also have access to databases that can be used to verify driver’s license information. They can check the license number, the name of the license – holder, and other details against official records. For example, they may connect to the state’s Department of Motor Vehicles (DMV) database. When a customer presents a driver’s license for a transaction, the bank can enter the license number and other relevant information into their system, which then queries the DMV database. If the information in the database does not match the information on the presented license, it could be a red flag. This could be due to a fake license or a case of identity theft where the wrong information has been used.

Signature Comparison

The signature on the driver’s license is another important verification point. When a customer signs a document at the bank, the bank representative will compare the signature on the document with the signature on the driver’s license. This requires some level of expertise in handwriting analysis. Genuine signatures usually have consistent pen pressure, slant, and style. If the signature on the document and the license do not match in terms of these characteristics, it may prompt further investigation. However, it’s important to note that minor differences in signatures can occur due to factors such as the writing instrument used or the speed of signing, so a single difference may not necessarily mean the license is fake.

Biometric Verification (in some cases)

In more advanced verification scenarios, some banks may use biometric data to verify a driver’s license. For example, fingerprint or facial recognition technology can be employed. If a bank has a customer’s biometric data on file from a previous enrollment process, they can compare the biometric data obtained at the time of license presentation with the stored data. This provides an additional layer of security as biometric data is unique to each individual and very difficult to forge. However, the use of biometric verification is not yet widespread in all banks and for all driver’s license – related transactions.

Common Problems and Solutions

Problem 1: Poor – quality visual inspection

Sometimes, bank employees may not be well – trained in visual inspection of driver’s licenses. This can lead to fake licenses being missed. The solution is to provide comprehensive and regular training to bank staff. This training should cover all the visual aspects of driver’s license security features, including holograms, text quality, and material characteristics. Additionally, banks can provide visual aids and reference materials to help employees during the inspection process.

Problem 2: Database inaccuracies

The databases that banks rely on for driver’s license verification may have inaccuracies. For example, the DMV database may not have been updated with the latest information for a particular license – holder. In such cases, a false positive (flagging a genuine license as fake) or false negative (missing a fake license) can occur. The solution is for banks to establish regular communication channels with the relevant authorities, such as the DMV. This can help ensure that the databases are updated in a timely manner. Additionally, banks can implement secondary verification methods in case of database – related discrepancies.

Problem 3: Signature forgeries that are difficult to detect

Skilled forgers may be able to create signatures that closely resemble the genuine one. This can make it difficult for bank employees to detect the forgery during signature comparison. To address this, banks can invest in advanced handwriting analysis software. These software programs can analyze signatures based on a wide range of parameters, such as pen pressure, stroke length, and curvature. Additionally, banks can cross – reference the signature with other documents on file to look for any patterns or inconsistencies.

Problem 4: UV – reactive ink fading or malfunctioning

Over time, the UV – reactive inks on a driver’s license may fade, or the UV – light testing equipment at the bank may malfunction. This can lead to false results during the UV – light inspection. The solution is for banks to regularly check and maintain their UV – light testing equipment. They should also be aware of the potential for ink fading and consider other verification methods if the UV – light inspection is inconclusive. For example, they can rely more on data verification and signature comparison in such cases.

Problem 5: Difficulty in biometric data matching

In cases where biometric verification is used, there may be difficulties in accurately matching the biometric data. Factors such as changes in appearance (for facial recognition) or dirt on the fingers (for fingerprint recognition) can cause false non – matches. To solve this, banks should provide clear instructions to customers on how to present their biometric data for accurate matching. They can also implement fallback verification methods in case the biometric data cannot be successfully matched. For example, they can rely on visual inspection and data verification as secondary measures.

Fake ID Pricing

unit price: $109

| Order Quantity | Price Per Card |

|---|---|

| 2-3 | $89 |

| 4-9 | $69 |

| 10+ | $66 |