Opening a bank account is a common – place financial activity that individuals engage in for various reasons, such as saving money, making transactions, and accessing financial services. Banks have strict requirements and procedures when it comes to account – opening to ensure the security of their customers’ funds and compliance with relevant laws and regulations. One of the key aspects of the account – opening process is the verification of the customer’s identity.

Identification Requirements for Bank Account Opening

Banks typically require valid and government – issued identification documents to verify the identity of the person opening an account. Commonly accepted documents include passports, national identity cards, and driver’s licenses. These documents contain important information such as the individual’s full name, date of birth, photograph, and a unique identification number. The purpose of using these documents is to confirm that the person presenting themselves for account opening is who they claim to be and to prevent fraud and money – laundering activities.

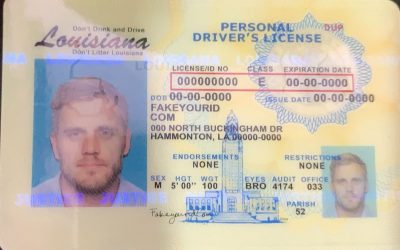

Driver’s licenses are a popular form of identification because they are widely issued and contain a significant amount of personal information. However, it is important to note that only genuine, valid driver’s licenses are acceptable for bank account opening. A fake driver’s license is a counterfeit document that has been fraudulently created to imitate a real one.

The Illegality of Using a Fake Driver’s License

Using a fake driver’s license for any purpose, including opening a bank account, is illegal. Counterfeiting official documents is a criminal offense in most jurisdictions. When a person attempts to use a fake driver’s license to open a bank account, they are engaging in identity fraud and document forgery. Banks have sophisticated methods of verifying the authenticity of identification documents. They may check the document’s security features, such as holograms, watermarks, and microprinting. They may also cross – reference the information on the document with government databases or other reliable sources.

If a bank detects that a customer has presented a fake driver’s license during the account – opening process, several consequences can occur. First, the bank will immediately reject the account – opening application. The bank may also report the incident to the relevant law enforcement agencies, such as the police or the financial crime unit. The individual involved may face criminal charges, which can include fines, imprisonment, or both. In addition to the criminal penalties, the person’s credit history may be negatively affected, making it more difficult for them to access financial services in the future.

Bank Verification Processes

Banks invest heavily in technology and processes to ensure the accuracy of identity verification. Many banks now use biometric technology, such as fingerprint or facial recognition, in addition to document – based verification. This multi – factor authentication approach helps to further enhance security. When a customer presents a driver’s license, bank employees are trained to carefully examine the document for any signs of tampering or forgery. They may also use specialized equipment to check for security features that are not visible to the naked eye.

Furthermore, banks may conduct background checks on the applicant. These checks can include verifying the person’s address, employment status, and credit history. If any discrepancies or red flags are detected during the verification process, the bank may request additional documentation or further investigation before approving the account – opening application.

Alternatives to Using a Fake Driver’s License

If an individual does not have a valid driver’s license but needs to open a bank account, there are several alternative identification documents that they can use. As mentioned earlier, passports are a widely accepted form of identification. National identity cards, which are issued by many countries, are also commonly used for bank account opening. In some cases, utility bills or bank statements in the applicant’s name can be used as proof of address in combination with another form of identification.

It is important for individuals to understand the importance of using legitimate identification documents when opening a bank account. By following the proper procedures and providing accurate information, they can ensure a smooth and legal account – opening process. This not only protects the individual from potential legal issues but also helps to maintain the integrity of the banking system.

Common Problems and Solutions Related to Bank Account Opening and Identification

- Problem: Lost or Stolen Identification Documents

Solution: If an individual has lost or had their identification document (such as a driver’s license or passport) stolen, they should first report the loss or theft to the relevant authorities. For a driver’s license, they need to contact the local Department of Motor Vehicles (DMV) or equivalent agency and apply for a replacement. For a passport, they should contact the passport office. Once they have obtained a replacement document, they can use it for bank account opening. In the meantime, if they need to open an account urgently, they can check with the bank if they accept other forms of identification or temporary documents. - Problem: Expired Identification Documents

Solution: If an individual’s identification document, such as a driver’s license, has expired, they should renew it as soon as possible. For a driver’s license, the renewal process usually involves visiting the DMV, providing the necessary documents (such as proof of identity and address), and paying the renewal fee. Once the document is renewed, it can be used for bank account opening. Some banks may also accept an expired document along with proof of the renewal application in certain cases, but it is best to check with the bank in advance. - Problem: Incomplete or Incorrect Information on Identification Documents

Solution: If there is incomplete or incorrect information on an identification document (such as a misspelled name or wrong address), the individual should correct it. For a driver’s license, they can visit the DMV and request a correction. They may need to provide supporting documents to prove the correct information. Once the correction is made, the updated document can be used for bank account opening. In the case of a passport, they should contact the passport office for the correction process. Banks may reject an account – opening application if the information on the identification document does not match the applicant’s details provided during the application process. - Problem: Difficulty in Providing Proof of Address

Solution: Some banks require proof of address in addition to identification documents for account opening. If an individual has difficulty providing proof of address (for example, if they have recently moved and do not have any utility bills in their new name yet), they can consider using other acceptable documents such as a lease agreement, a letter from a government agency addressed to their new address, or a bank statement from another bank with their current address. It is important to check with the bank which documents are acceptable as proof of address. - Problem: Language Barriers in Understanding Identification Requirements

Solution: If an individual has a language barrier and has difficulty understanding the identification requirements for bank account opening, they can seek help. Many banks have customer service representatives who can speak multiple languages or provide translation services. They can also ask a friend, family member, or interpreter who is fluent in both languages to assist them. Additionally, some banks provide information about account – opening requirements in multiple languages on their websites or in their branches, which can be very helpful for non – native speakers.

Fake ID Pricing

unit price: $109

| Order Quantity | Price Per Card |

|---|---|

| 2-3 | $89 |

| 4-9 | $69 |

| 10+ | $66 |