Introduction

The presence of fake driver’s licenses is a concerning issue that has far – reaching implications for various sectors, and one of the most affected is the insurance industry. Insurance companies rely on accurate information about policyholders, especially those related to driving, to assess risks and set appropriate premiums. When fake driver’s licenses come into play, it disrupts this delicate balance and causes a host of problems.

The Prevalence of Fake Driver’s Licenses

Fake driver’s licenses are more common than one might think. They are often obtained through illegal channels, either from counterfeiters who use sophisticated technology to replicate the look and feel of real licenses or through fraudulent means such as identity theft. In some cases, individuals may be tempted to obtain a fake license if they are unable to pass the legitimate driving tests or if they have had their real license revoked for various reasons.

The use of fake driver’s licenses is not limited to a particular region or demographic. It can occur in both urban and rural areas, and among people of different ages and social backgrounds. This widespread nature makes it a significant problem for the insurance industry, which has to deal with the potential consequences of these fake documents.

Impact on Insurance Premiums

One of the most direct impacts of fake driver’s licenses on the insurance industry is on insurance premiums. Insurance companies base their premium calculations on the risk profile of the driver. When a person with a fake license obtains insurance, the company has no way of accurately assessing their true driving ability and history. If such a driver is involved in an accident, the insurance company may end up paying out claims that it would not have if it had known the truth about the license.

To cover these unexpected losses, insurance companies often have to raise premiums for all policyholders. This means that honest drivers who have valid licenses and good driving records end up paying more for their insurance because of the actions of those with fake licenses. It creates an unfair situation where the burden of fraud is shifted onto the shoulders of law – abiding customers.

Fraudulent Claims and Losses

Fake driver’s licenses are often associated with fraudulent insurance claims. A person with a fake license may be more likely to engage in risky driving behavior, knowing that they are operating outside the bounds of the law. If they are involved in an accident, they may file false claims, exaggerating the extent of the damage or the injuries sustained. Insurance companies may not be able to detect the fraud immediately, especially if the fake license is well – made and the driver has also fabricated other details related to the incident.

These fraudulent claims result in significant financial losses for insurance companies. In addition to the direct cost of paying out false claims, there are also the costs associated with investigating these claims, which can be time – consuming and expensive. The losses incurred due to fraudulent claims related to fake driver’s licenses can have a negative impact on the financial stability of insurance companies, which in turn can affect their ability to provide competitive insurance products and services to legitimate customers.

Challenges in Detection

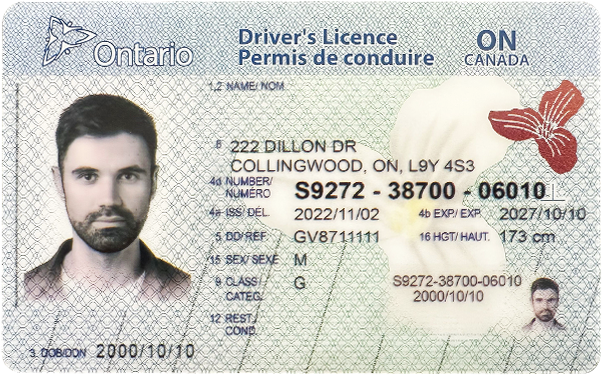

Detecting fake driver’s licenses is a major challenge for the insurance industry. As counterfeit technology improves, fake licenses are becoming increasingly difficult to distinguish from real ones. Insurance companies often rely on visual inspection and basic verification methods, such as checking with the relevant motor vehicle departments. However, these methods may not be sufficient in all cases.

Some fake licenses are so well – crafted that they can pass a cursory visual inspection. Additionally, motor vehicle departments may have limitations in terms of the information they can provide in a timely manner, especially if the license in question is from a different jurisdiction. This makes it difficult for insurance companies to accurately determine the authenticity of a driver’s license at the time of underwriting or when a claim is filed.

Legal and Regulatory Implications

The use of fake driver’s licenses is illegal, and insurance companies have a legal obligation to report suspected cases of fraud. However, the legal and regulatory framework surrounding fake driver’s licenses and insurance fraud can be complex. Different states and countries may have different laws regarding the penalties for using a fake license and for insurance fraud.

Insurance companies also need to comply with various regulations when it comes to investigating and reporting fraud. This can add another layer of complexity to their operations. In some cases, the lack of clear and consistent regulations can make it difficult for insurance companies to take effective action against those using fake driver’s licenses and engaging in insurance fraud.

Common Problems and Solutions

-

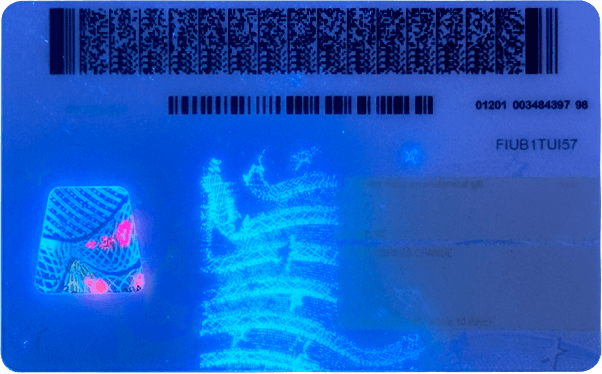

Problem: Difficulty in Visual Detection

As mentioned earlier, fake licenses are becoming more sophisticated, making it hard to tell them apart from real ones through visual inspection alone. This can lead to fake – licensed drivers being insured without the insurance company’s knowledge.

Solution: Insurance companies can invest in advanced document – verification technology. For example, using ultraviolet scanners to detect hidden security features in driver’s licenses that are not visible to the naked eye. They can also train their employees on the latest techniques for identifying fake documents, including understanding the细微 differences in printing quality, holograms, and watermarks.

-

Problem: Incomplete Information from Motor Vehicle Departments

Motor vehicle departments may not be able to provide comprehensive or up – to – date information about driver’s licenses, especially when dealing with licenses from other regions. This can prevent insurance companies from accurately verifying the authenticity of a license.

Solution: There needs to be better coordination and information – sharing between motor vehicle departments and insurance companies. This could involve the development of a national or international database that contains accurate and real – time information about driver’s licenses. Insurance companies could then access this database during the underwriting process to verify the authenticity of a license.

-

Problem: High Cost of Fraud Investigations

Investigating suspected cases of fraud related to fake driver’s licenses can be very expensive for insurance companies. This includes the cost of hiring investigators, conducting background checks, and gathering evidence.

Solution: Insurance companies can implement more efficient fraud – detection algorithms. By analyzing data such as driving patterns, claim history, and policyholder behavior, these algorithms can flag suspicious cases for further investigation. This can help to reduce the number of unnecessary investigations and save costs while still effectively detecting fraud.

-

Problem: Inconsistent Legal Regulations

The lack of consistent legal regulations across different regions makes it difficult for insurance companies to take uniform action against those using fake driver’s licenses and committing insurance fraud.

Solution: Governments at all levels should work towards harmonizing the legal regulations related to fake driver’s licenses and insurance fraud. This could involve creating model laws that can be adopted by different states or countries. Consistent regulations would make it easier for insurance companies to report fraud and for law – enforcement agencies to take appropriate action.

-

Problem: Lack of Public Awareness

The general public may not be fully aware of the serious consequences of using a fake driver’s license, both for themselves and for the insurance industry. This can lead to a higher prevalence of fake – license use.

Solution: Insurance companies, in collaboration with government agencies and law – enforcement, can launch public awareness campaigns. These campaigns can educate the public about the legal and financial implications of using a fake license, as well as the impact it has on honest policyholders. By increasing public awareness, it is hoped that the demand for fake driver’s licenses will decrease.

Fake ID Pricing

unit price: $109

| Order Quantity | Price Per Card |

|---|---|

| 2-3 | $89 |

| 4-9 | $69 |

| 10+ | $66 |