In the realm of financial institutions, customer onboarding is a crucial process that sets the foundation for a long – term relationship. However, the increasing sophistication of fake IDs poses a significant threat to this process, and as we approach 2025, the dangers are only expected to grow.

### The Rising Prevalence of Fake IDs

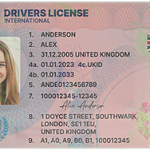

Fake IDs have been a concern for years, but technological advancements have made it easier for counterfeiters to create highly realistic documents. In 2025, it is anticipated that the quality of fake IDs will reach new heights, making it even more challenging for financial institutions to distinguish between genuine and forged documents. Counterfeiters are leveraging advanced printing technologies, such as high – resolution printers and specialized inks, to replicate the security features of official identification documents.

Moreover, the underground market for fake IDs is thriving. There are numerous websites and networks that offer to create and sell fake IDs, often with a high level of customization. These fake IDs can be designed to mimic various types of official documents, including passports, driver’s licenses, and national identity cards. This availability makes it attractive for individuals with malicious intent to obtain fake IDs for use in financial fraud.

### Dangers to Financial Institutions during Customer Onboarding

#### Identity Theft and Fraud

One of the most significant dangers of fake IDs in customer onboarding is identity theft. Fraudsters use fake IDs to assume the identities of legitimate individuals and open accounts with financial institutions. Once an account is opened, they can engage in a range of fraudulent activities, such as making unauthorized withdrawals, applying for loans in the victim’s name, or conducting money – laundering operations. This not only causes financial losses to the victim but also to the financial institution, which may be held liable for any fraudulent transactions.

#### Reputational Damage

When financial institutions are victims of fraud due to fake IDs during customer onboarding, it can have a severe impact on their reputation. Customers expect financial institutions to have robust security measures in place to protect their identities and assets. If a bank or other financial institution is found to have allowed fraudsters to open accounts using fake IDs, it can erode customer trust. This loss of trust can lead to customers withdrawing their accounts, negative word – of – mouth, and a decrease in new customer acquisition.

#### Regulatory Non – Compliance

Financial institutions are subject to strict regulations regarding customer identification and anti – money laundering (AML) and counter – terrorist financing (CTF) measures. Failing to properly verify the identities of customers during onboarding, especially when fake IDs are involved, can result in regulatory non – compliance. Regulatory authorities may impose hefty fines on financial institutions that do not adhere to these requirements, and it can also lead to more stringent regulatory scrutiny in the future.

### Challenges in Detecting Fake IDs in 2025

#### Advanced Security Features on Fake IDs

As mentioned earlier, counterfeiters are becoming more adept at replicating the security features of official IDs. Many fake IDs in 2025 may have features such as holograms, microprinting, and embedded chips that are difficult to distinguish from the real thing without specialized equipment. Financial institutions may find it challenging to keep up with these advancements and may not have the necessary tools or expertise to accurately detect these fake IDs during the onboarding process.

#### Remote Onboarding and Digital Fraud

The increasing trend of remote customer onboarding, especially in the digital age, has added another layer of complexity to fake ID detection. With more customers choosing to open accounts online, financial institutions rely on digital identity verification methods. Fraudsters are also exploiting this trend by using sophisticated digital techniques to present fake IDs in a convincing manner. For example, they may use photo – editing software to create realistic digital copies of fake IDs or use deep – fake technology to manipulate video or audio during identity verification processes.

### Strategies for Financial Institutions to Mitigate the Risks

#### Implementing Multi – Factor Authentication

Financial institutions should adopt multi – factor authentication (MFA) during the customer onboarding process. MFA requires customers to provide two or more forms of identification, such as a password, a one – time code sent to their mobile device, and biometric data (fingerprint, facial recognition). This adds an extra layer of security and makes it more difficult for fraudsters using fake IDs to pass the identity verification process.

#### Utilizing Advanced Identity Verification Technologies

Investing in advanced identity verification technologies is essential. These technologies can include document verification software that can analyze the security features of identification documents, biometric authentication systems that match the customer’s physical characteristics to the data on the ID, and identity verification services that cross – reference the customer’s information with multiple databases. By using these technologies, financial institutions can increase their accuracy in detecting fake IDs.

#### Staff Training and Awareness

Training employees on how to detect fake IDs is crucial. Staff members involved in the customer onboarding process should be educated about the latest trends in fake ID production, the security features of official documents, and the techniques for identifying suspicious behavior. Regular training sessions and updates on fraud prevention measures can help employees stay vigilant and improve their ability to spot fake IDs.

#### Collaboration with Law Enforcement and Industry Partners

Financial institutions should collaborate with law enforcement agencies and other industry partners to combat the problem of fake IDs. Sharing information about fake ID trends, fraud cases, and new detection methods can help all parties stay ahead of the fraudsters. Law enforcement agencies can also provide valuable support in investigating and prosecuting individuals involved in the production and use of fake IDs.

### Common Problems and Solutions in the Context of Fake IDs and Customer Onboarding

#### Problem 1: Inadequate Document Verification Tools

Solution: Financial institutions should invest in state – of – the – art document verification software. This software should be able to analyze various aspects of identification documents, such as the quality of the printing, the presence of security features, and the consistency of the data. Regularly updating the software to keep up with the latest fake ID trends is also essential.

#### Problem 2: Lack of Biometric Authentication in Onboarding

Solution: Incorporate biometric authentication methods, such as fingerprint or facial recognition, into the customer onboarding process. Biometric data is unique to each individual and provides a more reliable form of identity verification compared to traditional methods. Financial institutions can integrate biometric sensors into their digital onboarding platforms or use mobile – based biometric authentication apps.

#### Problem 3: Over – Reliance on Digital Identity Checks

Solution: While digital identity checks are convenient, they should not be the sole method of verification. Financial institutions should combine digital checks with manual reviews, especially for high – risk customers or transactions. Manual reviews can involve additional checks, such as contacting the customer’s references or verifying their address through independent sources.

#### Problem 4: Ineffective Staff Training

Solution: Develop a comprehensive staff training program that covers all aspects of fake ID detection. The program should include theoretical knowledge about the security features of different identification documents, practical training on using verification tools, and case studies of real – life fake ID fraud cases. Regularly assess the effectiveness of the training through quizzes and simulations.

#### Problem 5: Poor Data Integration in Identity Verification

Solution: Ensure that all identity verification systems and databases are integrated effectively. This allows for a more comprehensive check of the customer’s identity. For example, when verifying a customer’s identity, the system should be able to cross – reference data from multiple sources, such as credit bureaus, government databases, and fraud – detection databases. This integration can help identify any discrepancies or red flags that may indicate the use of a fake ID.

#### Problem 6: Lack of Customer Education

Solution: Educate customers about the importance of protecting their identities and the risks associated with fake IDs. Financial institutions can provide information through various channels, such as their websites, mobile apps, and customer service representatives. Encourage customers to report any suspicious activities related to their accounts or identity.

#### Problem 7: Slow Response to New Fake ID Trends

Solution: Establish a dedicated team or department that is responsible for monitoring and researching fake ID trends. This team should be in constant communication with law enforcement agencies, industry associations, and technology providers to stay updated on the latest developments. Based on this information, the financial institution can quickly adapt its identity verification processes and technologies.

#### Problem 8: Inadequate Fraud Monitoring after Onboarding

Solution: Implement a robust fraud – monitoring system that continuously monitors customer accounts for any suspicious activities after onboarding. This system should be able to detect patterns of behavior that may indicate fraud, such as unusual transaction volumes, sudden changes in spending habits, or attempts to access the account from unfamiliar locations. If any suspicious activity is detected, appropriate actions, such as freezing the account or contacting the customer for verification, should be taken immediately.

#### Problem 9: Difficulty in Verifying International IDs

Solution: For financial institutions that deal with international customers, verifying international IDs can be a challenge. They should invest in specialized international ID verification services that have access to global databases and are familiar with the security features of different countries’ identification documents. Additionally, they can establish partnerships with international identity verification providers to ensure accurate verification of international IDs.

#### Problem 10: High Costs of Identity Verification Technologies

Solution: While identity verification technologies can be expensive, financial institutions should view them as an investment in fraud prevention. They can explore cost – effective solutions, such as cloud – based identity verification services that offer pay – as – you – go pricing models. Additionally, they can seek partnerships with technology providers to negotiate better pricing and access to the latest technologies at a more affordable cost.

In conclusion, as we approach 2025, the threat of fake IDs to financial institutions’ customer onboarding processes is significant. However, by implementing the right strategies, such as multi – factor authentication, advanced identity verification technologies, staff training, and collaboration, financial institutions can mitigate these risks and protect themselves and their customers from the dangers of fraud.

Fake ID Pricing

unit price: $109

| Order Quantity | Price Per Card |

|---|---|

| 2-3 | $89 |

| 4-9 | $69 |

| 10+ | $66 |